How to Make 10000 Dollars in a Month by Passive Income Streams:

What is a Diverse or Passive Income Stream?

A various income circulation refers

to the practice of generating income from a couple of assets or streams instead of relying totally on a single supply of income. The idea of

diversifying profits is typically related to economic making plans and danger

management. By means of having income coming from diverse assets, and multiple sources of income, people or corporations can

reduce their dependency on one precise earnings circulation, which facilitates

mitigating the risks associated with economic fluctuations or adjustments in

the market. Passive income strategies also can provide greater economic

stability and security in case one of the income streams reviews a downturn or

turns unavailable.

Examples of Passive Sources of Income:

Examples of diverse earnings streams for individuals may consist of:

- Revenue or wages from a number of jobs

- Apart from mental profits from real property residences

- Dividend earnings from investments in shares or mutual finances

- Interest income from savings bills or bonds

- Freelance or consulting income from side initiatives

- Royalties from creative works such as books, songs, or patents

- Earnings from a small business or startup

- Associate advertising or advertising earnings from a weblog or website.

For groups, numerous earnings

streams might involve more than one product trace, offerings, or assets of

revenue that cater to exclusive client segments or industries. This method can

offer flexibility to modifications in demand or economic conditions inside

unique markets.

Fashionable, diversifying income

streams is a prudent financial technique that could contribute to lengthy-term

financial balance and increase. Its miles crucial to slowly examine the risks

and potential returns related to each profit source to ensure a balanced and

powerful method to create multiple streams of income.

Fundamental Kinds of Passive Income Streams:

Dynamic Earnings:

Dynamic earnings refers to earnings

that you receive as a result of actively collaborating in a process, change,

or business. This earnings is an immediate result of your private attempt,

time, and involvement. Commonplace examples of energetic profits encircle salaries,

wages, tips, commissions, and earnings from self-employment or freelance

paintings. It requires ongoing effort to keep and frequently stops while you

stop running.

Passive Earnings:

The second stream of income is passive

income, which is earnings that you earn with minimum ongoing attempts or direct

involvement. It's money generated from investments, business ventures, or

different earnings streams that don't require your energetic participation.

Examples of passive profits consist of rental earnings from actual estate properties,

dividend income from stocks, interest income from loans or investments, and

royalties from intellectual property. At the same time, as passive profits can

also require initial effort or funding, it continues to generate earnings with

less everyday involvement.

Portfolio Earnings:

Portfolio earnings refer to

earnings that come from the appreciation in cost of investments on your

portfolio. This will include capital profits from the sale of shares, bonds,

actual property, and other assets. It is the income you're making from buying

and selling belongings at earnings. While portfolio profits may be passive

in nature, it is wonderful from passive earnings in that it usually entails the

buying and promoting of property instead of ongoing ownership and earnings era

from that property.

Official Income:

Government earnings refer back to

the bills or advantages furnished by way of authorities' packages to people or

entities. This could consist of numerous sorts of financial guides, including:

Social Security:

A government software that offers retirement,

incapacity, and survivor benefits to eligible people.

Unemployment Benefits:

Bills are made to individuals who have lost their jobs and

meet particular criteria.

Welfare Help:

Economic aid is furnished to people or households in need

to assist cowl fundamental living fees.

Pensions:

Government pensions are retirement benefits supplied

to certain authorities’ employees, together with army employees or public

servants.

Subsidies:

Economic help is given to individuals or businesses to

assist specific activities or industries, together with agricultural subsidies.

It is essential to note that those

categories of profits can frequently overlap or paint together with every

other. For instance, someone may have a mixture of energetic income from a

complete-time job, passive earnings from condominium homes, portfolio profits

from investments, and authorities’ profits from social protection blessings in

retirement. Multiple sources of income ideas can provide more financial

stability and flexibility.

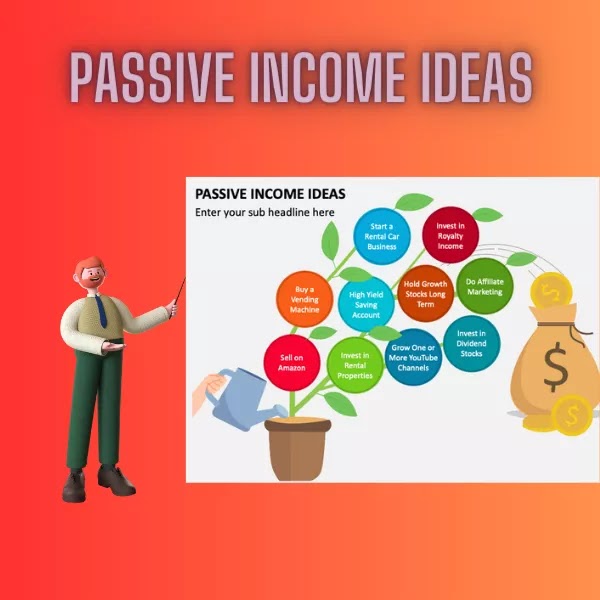

Passive Income Sources/ Multiple Streams of Income Ideas:

Freelance Websites:

Websites like Upwork, Freelancer,

and Fiverr permit you to offer your abilities and offerings to a global

marketplace. You can locate numerous freelance opportunities together with

writing, graphic layout, web development, and virtual advertising, and you can

discover more online income streams.

E-commerce Platforms:

Create an online save on systems

like Shopify, Etsy, or Amazon to promote merchandise, homemade crafts, virtual

downloads, or drop shipping objects.

Associate Marketing:

Be a part of associate applications

of various companies and promote their services or products via your internet

site, blog, or social media. You earn a fee for each sale made through your

referral hyperlink.

Online Guides and Tutorials:

When you have an understanding of a

specific discipline, you can create and sell online guides on structures like

Udemy, Teachable, or Coursera.

YouTube Channel:

Create and monetize a YouTube

channel by producing content material in regions like training, enjoyment,

vlogging, product reviews, or tutorials.

Stock Photography and Motion Pictures:

In case you are skilled in pictures

or videography, you could promote your work on inventory media websites like

Shutterstock, Adobe Inventory, or iStock.

Actual Property Crowdfunding:

Spend money on real property

properties through crowdfunding systems like Fundraise or Realty Mogul, which

give possibilities to earn rental income and capability assets appreciation.

Peer-to-Peer Lending:

Be a part of lending platforms like

Prosper or Lending Club to lend cash to people or small organizations and earn

interest for your investments.

App Improvement:

When you have programming skills,

you may create and sell cellular packages on app stores just like the Apple App

Shop or Google Play.

Print-on-demand Products:

Use platforms like Printful or

Redbubble to create custom merchandise like t-shirts, mugs, and contact cases

with your designs and promote them online.

Social Media Control:

Offer social media control services

to businesses and individuals to help them develop their online presence and

engagement.

Podcasting:

Start a podcast on topics that

interest you and monetize it via sponsorships, commercials, or listener guide

Remember that even as these sources

offer possibilities for various income streams, fulfillment frequently requires

determination, attempt, and non-stop development. It is crucial to select

alternatives that align together with your capabilities, pastimes, and

lengthy-time period goals. Moreover, continually research and keep in mind any potential dangers or demanding situations associated with every profit

movement.

Advantages, Flexibility, and Convenience of Diverse or Passive Income Streams:

Advantages of Diverse Income Streams:

Risk Reduction:

Having more than one profits streams reduces the

reliance on an available supply of profits. If one flows research a downturn or

turns volatile, different streams of income can help cushion the economic

effect, imparting greater resilience throughout monetary uncertainties.

Economic Stability:

Various profit streams contribute to an extra strong

economic scenario. Although one source of earnings fluctuates, others can keep generating sales, making sure ordinary cash goes with the flow to satisfy

charges and financial duties.

Increased Income Capability:

Diverse income streams permit humans to enter into

different markets and industries, potentially fundamental to better earning

possibilities. As every income circulate grows and matures, average income can

boom.

Skills Development:

Pursuing diverse income streams often entails exploring

particular regions of expertise. This manner can motivate potential development

and private boom, making individuals greater adaptable and precious within the

pastime market.

Entrepreneurial Opportunities:

Diversifying profits frequently entails

entrepreneurship or side organizations. This may offer people an

experience of autonomy and creativity in building and dealing with their

profits assets.

The Flexibility of Several Income Streams:

Lifestyles Balance:

Having numerous earnings streams can offer greater

flexibility in dealing with one's time desk. A few streams can also require

less effort and time, permitting people to create better lifestyle

stability.

Multiple Interests:

By manner of diversifying earnings, people can pursue

several passions and pastimes. This pliability can motivate a greater pleasant

and laugh-expert existence.

Online Types of Income Streams:

Many various profit streams, such as freelancing,

online corporations, and consulting, can be controlled remotely. This allows

people to adapt to their surroundings in a healthy manner.

Timing:

Some earnings streams might also additionally generate

sales at precise instances of the year or have varying rate schedules. This may

offer economic balance within the direction of the 12 months.

Component-Time Possibilities:

Various earnings streams regularly include thing-time

or gig-primarily based completely opportunities. This may be mainly beneficial

for individuals who pick out or require a greater flexible time arrangement.

Comfort of Various Earnings Streams:

Independence:

Diverse profit streams can reduce dependency on a

single business enterprise, providing individuals with greater management over

their economic nicely-being.

Passive Profits:

A few profit streams, like investments or royalties,

can generate passive earnings. As quickly as established, they require much less lively involvement, presenting a diploma of comfort and

capability for financial independence without non-stop attempts.

Account-Based Income Streams:

Many online-based income streams may be managed from

anywhere with an internet connection, making them highly handy for

digital nomads or those who decide upon area-unbiased paintings.

Scalability:

Certain income streams, such as online organizations,

have the capability for scalability. As these travel develop, people can

achieve greater rewards without growing their try.

Portfolio Management:

Dealing with diverse profit streams is similar to

developing a financial portfolio, wherein each flow contributes to normal

financial achievement. This method allows individuals to optimize their source of income.

Use of Numerous Earnings Streams:

The use of numerous earnings streams can be a clever

economic method to boom your standard profits and decrease dependence on a

single deliver of sales. Here are a few steps to effectively use numerous

earnings streams:

Become Aware of Your Skills and Passions:

Identifying your capabilities, skills, interests, and

expertise will help you to select earnings streams that align with your strengths.

Explore One in Every Type of Income Belonging:

Studies numerous income streams and possibilities that

fit your talents and hobbies. Some examples consist of:

- Entire-time venture or component-time paintings for your field of statistics.

- Freelancing or consulting on your location of knowledge.

- Passive income sources consist of investments, dividends, royalties, or rental earnings.

- Beginning a facet business or e-exchange keep.

- Developing and selling digital merchandise or online guides.

- Participating within the gig economy (e.g. journey-sharing, food transport, online undertaking structures)

Diversify your Investments:

In addition to lively profits assets, recollect

diversifying your investments. This will comprise putting coins into shares,

bonds, real estate, mutual finances, or other economic contraptions. Passive

income streams enable unfold hazards and offer an opportunity for capability

lengthy-time period boom.

Construct a Personal Brand:

Setting up a sturdy private brand can open up diverse

earnings opportunities. This may involve developing a blog, YouTube channel, or

social media presence to showcase your information, attract a target market,

and possibly monetize via subsidized content material fabric, or marketing.

Expand More Than One Streams Grade by Grade:

It's critical to begin slowly and consciousness of one

or two profit streams initially. As you advantage enjoy and stability, step by

step add new streams. Trying to control too many earnings assets right now

should result in burnout or reduced nicely on your artwork.

Live Organized and Manage Time Efficaciously:

Numerous profit streams can require careful time

control. Use gadgets and apps to live organized, set clean desires, and allocate

time to each earnings circulate efficaciously.

Display and Regulate:

Regularly investigate the performance of your numerous

income streams. Pick out which ones are the most worthwhile and thrilling, and

bear in mind doing away with or improving people who aren't appearing as

properly.

Adapt to Changes:

Monetary conditions and traits can alternate, affecting

profit streams in a different way. Be organized to conform your techniques,

discover new possibilities, and diversify further if wished.

Save and Make Investments Accurately:

As your earnings grow, work out clever monetary management

by using saving and making an investment correctly. Constructing a strong

economic basis can offer stability and permit you to take gain new

possibilities.

Understand that attaining success with diverse earnings

streams requires attempt, resilience, and adaptability. Hold gaining knowledge

of, live open to new possibilities, and constantly artwork towards your

economic goals.

FAQs

Q1: Why is it vital to have various profit streams?

Ans: Diversifying profits streams presents financial safety and

resilience. If one profit source falters, having alternative streams can

assist keep the average income balance. It also opens up opportunities for

capability boom and better income.

Q2: What are a few examples of numerous profit streams?

Ans: Various earnings streams can consist of various assets,

inclusive of a complete-time activity, freelance paintings, rental profits,

dividends from investments, royalties from creative paintings, associate

advertising and marketing, online guides, and more.

Q3: How can I become aware of extra profit streams that fit me?

Ans: Start by assessing your abilities, hobbies, and passions.

Search for opportunities that align with your strengths and supplement

your number one profits source. Remember online platforms, aspect agencies, or

investments that suit your understanding.

Q4: Are there any risks related to various earnings streams?

Ans: Yes, there are dangers involved. Dealing with more than one

income stream can be time-ingesting and can result in burnout if no longer

balanced properly. Additionally, a few ventures won't yield immediate returns,

which calls for patience and careful monetary making plans.

Q5: How am I able to efficaciously manipulate various profit

streams?

Ans: To control diverse earnings streams effectively, create a

complete economic plan. Set clear dreams for every income supply, hold a

budget, and prioritize time allocation. Automate price range if possible,

and search for expert recommendations if wished.

Q6: How to diversify income streams in retirement?

Ans: Diversifying earnings streams for the duration of retirement

is important to ensure financial stability and protection. Assess your

cutting-edge financial fame, which includes financial savings, investments,

pensions, and some other resources of retirement profits after which create

your retirement price range. You can discover new divert earnings streams like element-time paintings, Freelancing, apartment residences, investment plans, home

sharing, pursuit monetization, and so forth

Q7: Should I prioritize one profit movement over others?

Ans: Prioritizing income streams depends on your economic goals and

circumstances. Whilst a number one earnings source might also require more

interest, it's crucial to allocate time and assets to expand different streams

over time.

Q8: How can I keep away from ability tax implications with various

profit streams?

Ans: Seek advice from a tax professional or financial guide to

apprehend tax implications associated with unique profits resources. Proper tax

planning and information tax deductions can help optimize your universal

financial state of affairs.

Q9: Are there any precise legal considerations for creating diverse

profit streams?

Ans: Yes, the sort of earnings streams, you pursue, depends upon legal considerations. As an example, beginning a commercial enterprise may additionally require licenses and allows, even as investing may additionally have unique rules. It's essential to analyze and follow applicable laws and regulations.